Standalone industrial routers may not disappear, but their revenue market share is set to decline over the next five years to 2017, according to the report "Industrial Ethernet Infrastructure Components - World - 2013," from IHS.

Standalone routers in the past have been used to interface networks over longer distances, often via the Internet, providing the ability to link systems globally. Increasingly, however, Layer 3 switches are being introduced to the market that can perform the same routing functions. To date managed switches are used more often in industrial networking, but most have only Layer 2 functionality and cannot be used as a result for routing.

"The way networks are constructed is changing," said John Morse, senior automation analyst with IHS. "Most of the changes are forecast to be at the controller-to-controller and enterprise levels, particularly where networks are being linked together. These can be right next to each other or on the other side of the world."

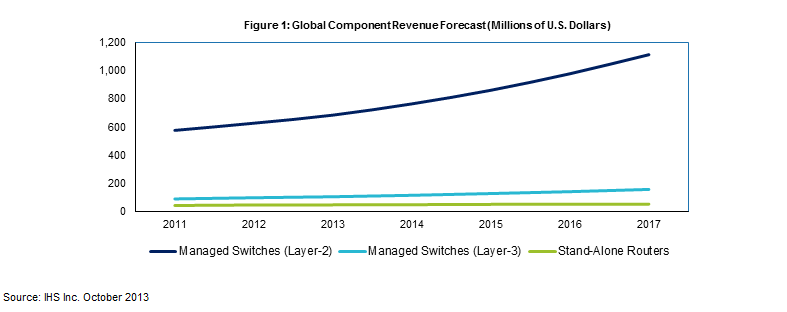

Managed switches are still important in industrial networking, as shown in Figure 1 of the attached, which compares forecast revenues for Layer 3 switches, Layer 2 switches and standalone routers. Figure 2 shows year-on-year revenue percentage growth, which illustrates the far higher growth rate forecast for Layer 3 managed switches compared to that of standalone routers.

Several drivers are behind this trend, IHS believes, of which cost is the most significant. A typical network will comprise many elements, including unmanaged and managed switches. By including a Layer 3 switch, the network has a gateway to wide-area networks, including the Internet. Such a structure then obviates the need for a separate router.

In addition to the cost savings that result from a reduced component count, system designers are able to employ the expanded product functionality that managed switches can provide, such as monitoring, data collection and port priority. While most suppliers for the industrial Ethernet components market interviewed for the report recognize the slower growth of router sales, they believe they will have a place in modern industrial networks for the foreseeable future.