Following Interact Analysis first report on the geared motors and industrial gearbox market (Article from IEN Europe here), covering the full spectrum – geared motors, solo gearboxes, industrial heavy-duty gears and planetary gearboxes, the organization published a follow up blog post. In this insight, they focus on the two products which occupy the largest slice of this market – light-duty geared motors and solo gearboxes.

The move towards geared motors

Customers are being increasingly attracted to integrated, packaged solutions, which offer cost and maintenance advantages over solutions where gearbox and motor are purchased separately. Geared motors are the leading technology in the market. They effectively remove the need for the shaft coupling and mounting required when gears and motors are bought separately. This is not only a space-saving solution. It ensures compatibility between gearbox and motor. As an added plus, combined solutions from a single vendor offer the possibility, through digitalization, of predictive maintenance, a factor increasingly recognised as crucial to assuring smooth and continued manufacturing output. Notwithstanding the clear advantages of packaged solutions, the take-up varies across the world.

Regional Perspective

End-users in EMEA have commonly gone for more integrated machinery. Companies headquartered in Europe produced over 66% of the global market of geared motors and solo gearboxes in 2019, with Japan second on 13%, and the Americas third on around 10%. The preference in the Americas has traditionally been to purchase solo gearboxes and motors separately, often from different vendors. The ability to replace just the motor in the event of a failure was seen as being a bigger cost advantage than the space-saving plusses associated with packaged solutions. The market in the Americas is also influenced by the traditionally strong presence of motor manufacturers who do not provide their own gearbox equipment. But things are changing. Even in the Americas, integrated geared motors accounted for more than 50% of revenues in 2019, and that share is expected to increase over time. Where the market for integrated geared motors is concerned, APAC falls somewhere in the middle of EMEA and the Americas.

Most popular products

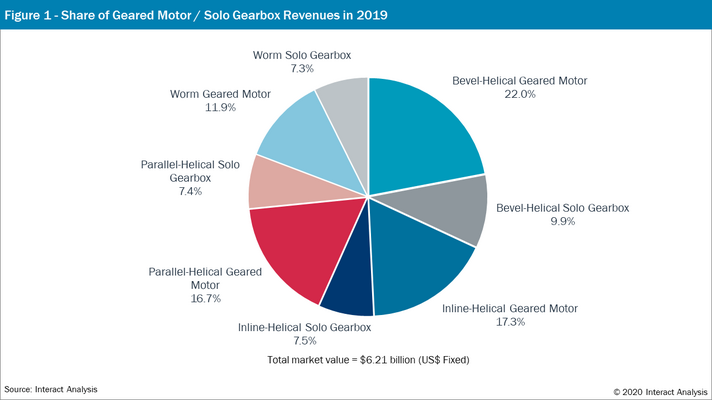

Of the four major product groups – bevel, inline, parallel and worm-based; bevel-based products occupy the largest segment of the geared motor and solo gearbox market and are forecast to continue to do so. They accounted for 30% of revenues for the sector in 2019, offering space-saving advantages, and greater efficiency than the other product groups. Inline and parallel solutions, which fulfil similar customer needs, occupied the next two positions in the market and are expected to achieve similar growth during the forecast period (up to 2024). Worm-based products occupied the smallest section of the market. They offer a lower price point compared to the other product groups, but with that they have much lower mechanical efficiency.

The market for worm-based solutions would certainly be in decline were it not for their use in applications in APAC (China especially) where lowest cost is a key choice factor.

Factors driving the market

There are two main factors at play in the geared motors and solo gearbox market. Firstly, certain products are tending to replace others. As the price differential reduces, for example, bevel-helical equipment is replacing worm-based machinery in some applications requiring right-angle solutions. Customers are attracted by the greater efficiency of bevel products. As we have also already seen, customers are attracted by packaged solutions. The second major factor at play in the market is the swift growth of end-user industries and machinery sectors that use geared solutions. Growth naturally stimulates demand. As automation continues apace, the demand for geared motors and solo gears will grow. Geared motors are an integral component of any automation system that requires speed increases or reductions and power transmission, so as automated processes and manufacturing continue to expand so will demand for geared products.

Machinery replacement is another major factor pushing demand. As the market continues to grow, calls for replacement of equipment will also increase. If we can assume that the average lifespan of a geared motor/solo gearbox is 5 years, this means that every year roughly one-fifth of the total number of units in service will need replacing.

Flexibility is another market driver. As consumer demand for more individualized products and different packaging or product orientations increases, so does the need for increasing machine flexibility and functionality. This is pushing the development and subsequently market power of geared motors and solo gearboxes. There is increased demand, for instance, for decentralized geared motors with built-in drives which are suited to limited space in control cabinets. The demand for increased flexibility has so far been a mainly European trend, but it is now appearing in the Americas, and will spread into more developed parts of APAC in due course.

End-user destinations for geared motors and solo gearboxes

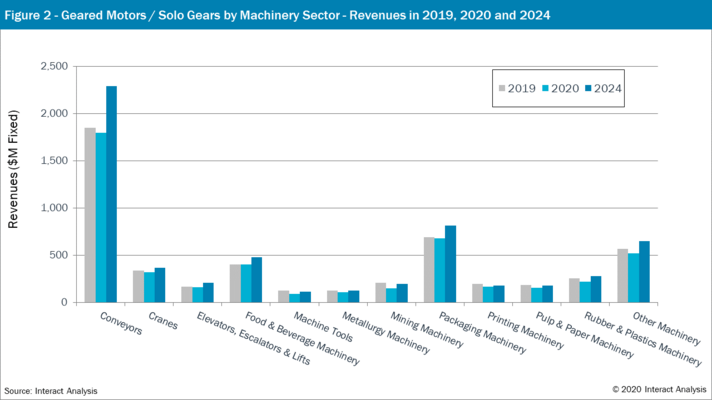

Interact Analysis has done extensive research into the industrial applications of these light-duty machines, with results described in the graphic (See Figure 2).

As can be seen in Figure 2, the range of machinery application scenarios for geared motors/solo gearboxes is considerable, with conveyors, food and beverage machinery and packaging machinery leading the way, as automation continues apace.

Geared motors/solo gearboxes: leading producers

In 2019, SEW Eurodrive, headquartered in Bruchsal, Germany, led the way in the market, accounting for 36% of global revenues. Nord Drivesystems, another German company came in second with 11% and Sumitomo, a Japanese manufacturer, third with 8%. As well as these major players, there is a long list of specialist suppliers with a narrower focus that is directed specifically around a portfolio of gearbox products, or a specific region or industry.

Tim Dawson, Senior Research Director - Interact Analysis