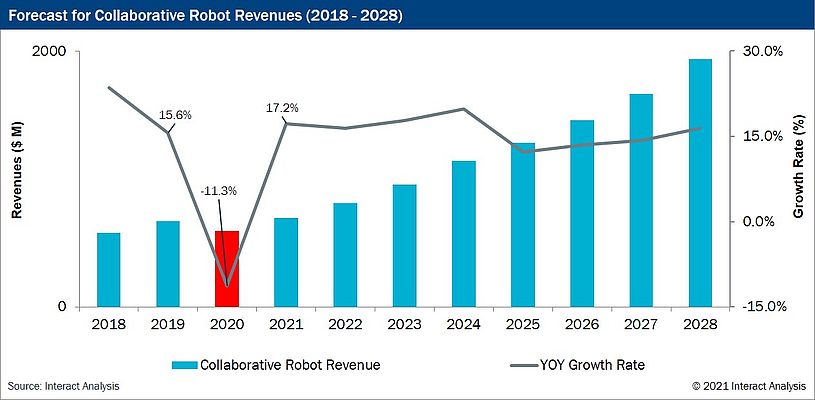

Interact Analysis has released a new report on the collaborative robot market. The report reviews what turned out to be a difficult 2019 and a tumultuous 2020 but gives reason for optimism for the sector from now up to 2028, with significant growth predicted.

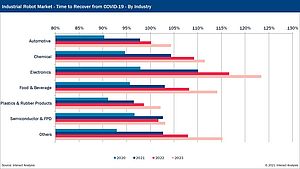

As is the case with many industries, Covid-19 has severely affected the short and medium-term outlook for the collaborative robot sector. In 2020 the market saw negative growth for the first time -11.3% in revenue terms, and -5.7% in shipment terms. Factory and warehouse closures slowed down demand; and customers became more cautious about investment, leading to delays or even cancellations of orders. But Interact Analysis’s research indicates that there will be a V-shaped rebound for the industry which will result in growth of nearly 20% in 2021, surpassing 2019 market size.

Over half of collaborative robots were shipped to Asia in 2020

Thereafter up to 2028 there will be an annual growth rate of the order of 15-20%. The forecast has been lowered considerably compared to the equivalent 2019 report, the main reasons being, besides the Covid effect, competition from small articulated and SCARA robots in industrial settings, and the slower than expected increase in cobot installations in non-industrial applications but, in these turbulent times, the outlook looks good for the sector.

The impact of Covid-19 on the cobot market varies from region to region. The virus started in the Asian regions and then moved to Europe and North America. As a result, normal business operations and commissioning of automation projects in the Asia-Pacific region will resume earlier than in other regions. This is important for the cobot market, as over 50% of cobots were shipped to Asian countries in 2020. However, only the Chinese and, interestingly, the North American markets are forecast to surpass the size of 2019, mainly due to large domestic demand. China has seen high take-up of cobots because the country, as the world’s largest manufacturing base, is suffering from a labour shortage and is in strong need of higher levels of automation to improve production efficiency. By 2022 all regions are predicted to have exceeded the 2019 market-size, with Western Europe, along with China and North America seeing the fastest growth rates.

Electronics manufacturing is the largest consumer of cobots, but other sectors are recognising their potential

Jan Zhang, senior director at Interact Analysis tells us: “Collaborative robots are still the new kid on the block. Their application potential hasn’t been fully exploited yet, by any means. At present, electronics is by far the biggest end-industry employing cobots, but their potential is now being recognised across a range of sectors. Their flexibility and ease of use makes them strong candidates for logistics, services and even education applications. Our research tells us that those non-manufacturing areas will account for 21.3% of collaborative robot revenues by 2024. Our little Cobot friends are certainly set to enjoy significant growth compared to other robot types!”