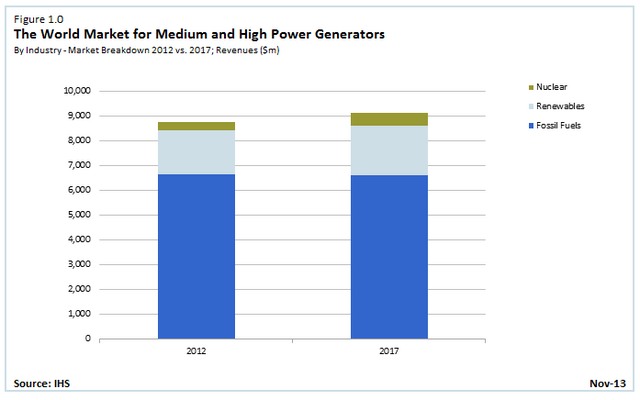

The fossil fuels sector dominates the medium and high power generator markets, accounting for approximately 76% of revenues in 2012 according to recent findings by IHS. However, the share of new generator sales that utilize fossil fuels is forecast to decline as growth in the renewables and nuclear sectors ramps up.

Generators sold into the renewables (excluding wind and solar PV) and nuclear industry sectors are forecast to experience significant growth through 2017. Power generated by renewable sources is considered carbon neutral, and government legislation in many countries has been enacted to reduce carbon emissions in an attempt to reverse the harmful effects of climate change. Because of this, generators sold into hydro and other renewables such as biomass and solar CSP (Concentrated Solar Power) are seeing rapid growth.

Despite the backlash from the Fukushima nuclear disaster in 2011 and Germany deciding to close down all of its nuclear power plants by 2022, the nuclear industry is projected to see a resurgence through 2017 and beyond. Nuclear power, which is also carbon neutral, will see most of the growth from only a few countries, including China, India, Iran, Russia and South Korea. Nuclear power is attractive in these countries because of the need for large increases to their base load capacity in order to keep pace with growing demand. Furthermore, these countries have historically relied on coal fired power plants for electricity generation, especially China and India. Adding nuclear power allows them to reduce carbon emissions while at the same time helps to clean up their image as high carbon emitters.

The discrepancy of natural gas prices and delays in project financing are other factors keeping generator sales prospects for the fossil fuels sector subdued. The United States saw a large impact as gas prices fell to historically low levels mainly due to the increase in production from shale gas fracking. However, this gas boom has not yet spread to Europe and Asia where natural gas prices are three to four times higher. Financing and investments for large power plants have also been more difficult to secure, which has led to delays in equipment purchases.